Stock Rally Loses Steam After Mixed Tariff News: Markets Wrap

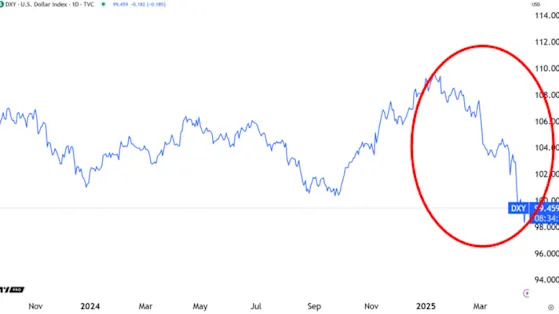

(Bloomberg) -- A global rally in equities stalled as mixed signals from the Trump administration on its plans for China tariffs dented investors’ appetite for risk.Most Read from BloombergTrump Gives New York ‘One Last Chance’ to End Congestion FeeWhy Car YouTuber Matt Farah Is Fighting for Walkable CitiesThe Racial Wealth Gap Is Not Just About MoneyBackyard Micro-Flats Aim to Ease South Africa’s Housing CrisisTo Fuel Affordable Housing, This Innovation Fund Targets Predevelopment CostsStocks in