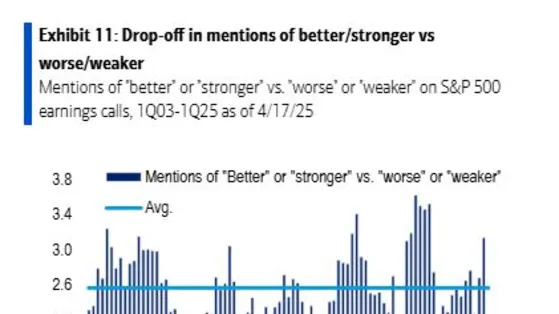

CEO gloom rivals financial crisis as tariffs hit S&P 500 stocks

(Bloomberg) -- Not since the financial crisis has Corporate America been so downbeat about the state of the economy in earnings calls, an ominous sign for investors trying to figure out how much more pain Donald Trump’s trade war will inflict on the stock market.Most Read from BloombergTrump Gives New York ‘One Last Chance’ to End Congestion FeeDOGE Visits National Gallery of Art to Discuss Museum’s Legal StatusThe Racial Wealth Gap Is Not Just About MoneyBackyard Micro-Flats Aim to Ease South A