Fast food chain El Pollo Loco (NASDAQ:LOCO) reported Q1 CY2025 results topping the market’s revenue expectations , with sales up 2.6% year on year to $119.2 million. Its non-GAAP profit of $0.19 per share was in line with analysts’ consensus estimates.

Is now the time to buy El Pollo Loco? Find out in our full research report .

El Pollo Loco (LOCO) Q1 CY2025 Highlights:

Liz Williams, Chief Executive Officer of El Pollo Loco Holdings, Inc., stated, “Our first quarter results fell short of our expectations on sales and store level profit. Despite the challenges we faced with the dynamic consumer environment, we delivered proof points that reinforce our belief in the brand’s long-term opportunity. From showing that menu innovation can drive trial of the brand through the launch of Mango Habanero, to identifying opportunities to further improve operational execution in our restaurants, we are proud of our accomplishments and believe we still have tremendous upside. Looking ahead, our focus remains squarely on executing the multitude of initiatives that we have in place to drive our brand forward.”

Company Overview

With a name that translates into ‘The Crazy Chicken’, El Pollo Loco (NASDAQ:LOCO) is a fast food chain known for its citrus-marinated, fire-grilled chicken recipe that hails from the coastal town of Sinaloa, Mexico.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $476 million in revenue over the past 12 months, El Pollo Loco is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

As you can see below, El Pollo Loco grew its sales at a weak 1.4% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts) as it barely increased sales at existing, established dining locations.

This quarter, El Pollo Loco reported modest year-on-year revenue growth of 2.6% but beat Wall Street’s estimates by 0.6%.

Looking ahead, sell-side analysts expect revenue to grow 4.7% over the next 12 months. Although this projection suggests its newer menu offerings will spur better top-line performance, it is still below the sector average.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. .

Restaurant Performance

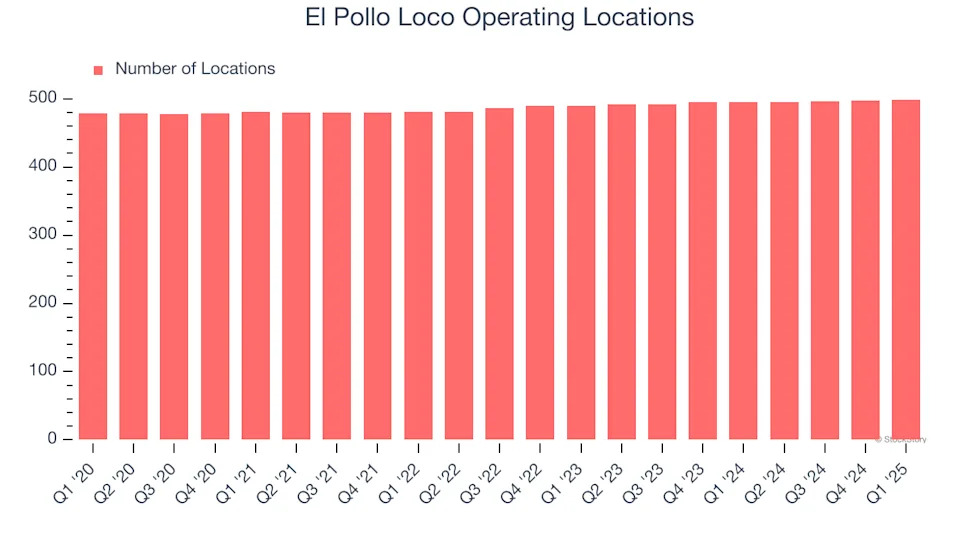

Number of Restaurants

A restaurant chain’s total number of dining locations often determines how much revenue it can generate.

El Pollo Loco sported 499 locations in the latest quarter. Over the last two years, it has generally opened new restaurants, averaging 1% annual growth. This was faster than the broader restaurant sector.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

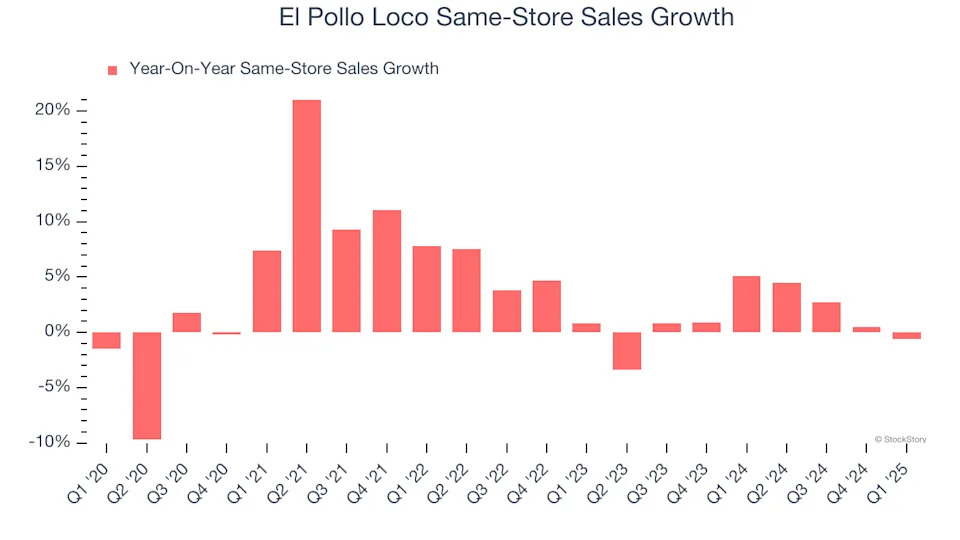

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth at restaurants open for at least a year.

El Pollo Loco’s demand within its existing dining locations has been relatively stable over the last two years but was below most restaurant chains. On average, the company’s same-store sales have grown by 1.3% per year. This performance suggests it should consider improving its foot traffic and efficiency before expanding its restaurant base.

In the latest quarter, El Pollo Loco’s year on year same-store sales were flat. This was a meaningful deceleration from its historical levels. We’ll be watching closely to see if El Pollo Loco can reaccelerate growth.

Key Takeaways from El Pollo Loco’s Q1 Results

It was encouraging to see El Pollo Loco beat analysts’ revenue and EBITDA expectations this quarter. On the other hand, its same-store sales slightly missed. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The stock remained flat at $9.50 immediately after reporting.

Should you buy the stock or not? We think that the latest quarter is just one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .