Scientific consulting firm Exponent (NASDAQ:EXPO) announced better-than-expected revenue in Q1 CY2025, with sales up 6% year on year to $145.5 million. On the other hand, next quarter’s revenue guidance of $130 million was less impressive, coming in 3.8% below analysts’ estimates. Its GAAP profit of $0.52 per share was 8% above analysts’ consensus estimates.

Is now the time to buy Exponent? Find out in our full research report .

Exponent (EXPO) Q1 CY2025 Highlights:

“Exponent’s first quarter results exceeded expectations, reinforcing both the resilience of our diversified business model and the value we deliver,” said Dr. Catherine Corrigan, President and Chief Executive Officer.

Company Overview

With a team of over 800 consultants holding advanced degrees in 90+ technical disciplines, Exponent (NASDAQ:EXPO) is a science and engineering consulting firm that investigates complex problems and provides expert analysis for clients across various industries.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $526.8 million in revenue over the past 12 months, Exponent is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

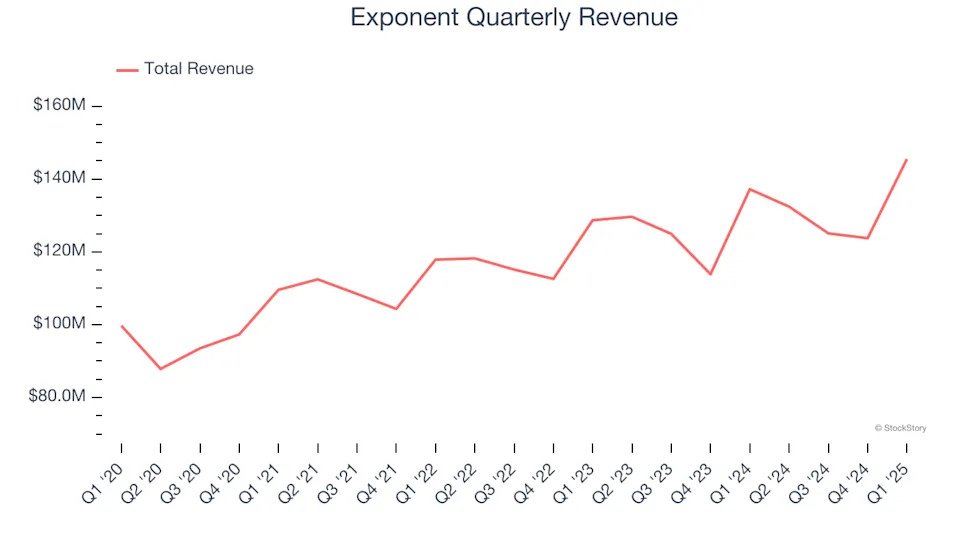

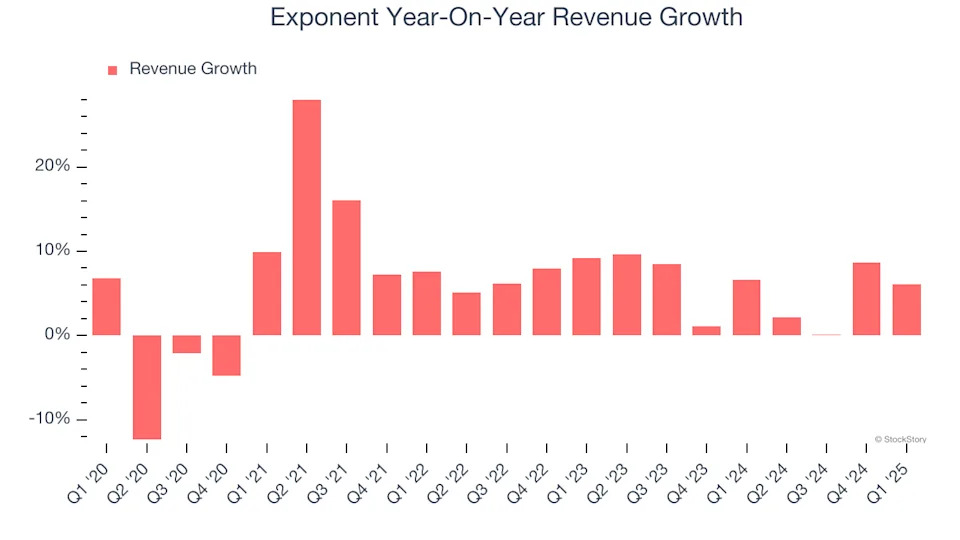

As you can see below, Exponent’s 5.8% annualized revenue growth over the last five years was decent. This shows its offerings generated slightly more demand than the average business services company, a useful starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Exponent’s annualized revenue growth of 5.3% over the last two years aligns with its five-year trend, suggesting its demand was stable.

This quarter, Exponent reported year-on-year revenue growth of 6%, and its $145.5 million of revenue exceeded Wall Street’s estimates by 8.1%. Company management is currently guiding for a 1.8% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.1% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and implies its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Exponent has been a well-oiled machine over the last five years. It demonstrated elite profitability for a business services business, boasting an average operating margin of 24.5%.

Analyzing the trend in its profitability, Exponent’s operating margin rose by 6.9 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, Exponent generated an operating profit margin of 30.5%, up 8.2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

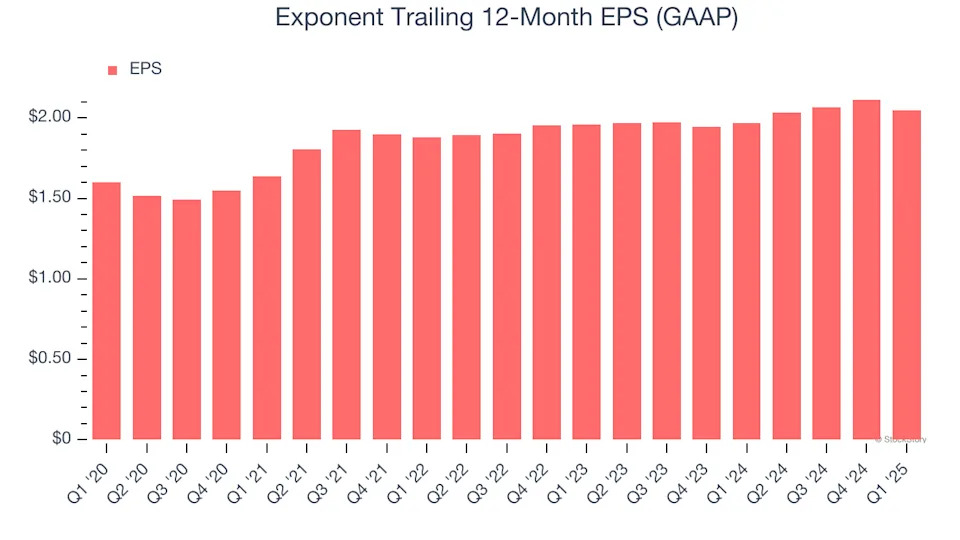

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Exponent’s unimpressive 5.1% annual EPS growth over the last five years aligns with its revenue performance. On the bright side, this tells us its incremental sales were profitable.

In Q1, Exponent reported EPS at $0.52, down from $0.59 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 8%. Over the next 12 months, Wall Street expects Exponent’s full-year EPS of $2.05 to shrink by 1.2%.

Key Takeaways from Exponent’s Q1 Results

We were impressed by how significantly Exponent blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed significantly and its full-year revenue guidance fell slightly short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $77.82 immediately after reporting.

Is Exponent an attractive investment opportunity right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free .