Key Takeaways

Just 100 days into President Donald Trump's second presidency, his sweeping efforts to remake the U.S. economy are starting to show results.

Starting on the first day of his presidency, Trump unleashed a barrage of executive orders, some of which have had dramatic and immediate impacts on the economy. Trump signed 142 executive orders over 100 days, beating the previous record-holder, Franklin Roosevelt, who signed 99 in 1933, according to an analysis by Deutsche Bank. Trump had signed only 33 by this point in his first term, and Biden just 42.

Many of those orders were related to trade: Trump

imposed heavy tariffs

on U.S. trading partners, including a 145% tariff on most products from China. These orders are a

sweeping reversal of the post-WWII era

of free trade policies implemented by U.S. presidents. Trump has said he intends the tariffs to

revive U.S. manufacturing jobs

and

raise revenue

to run the government. The economy has just started to feel the effects of those orders, most of which went into effect in April.

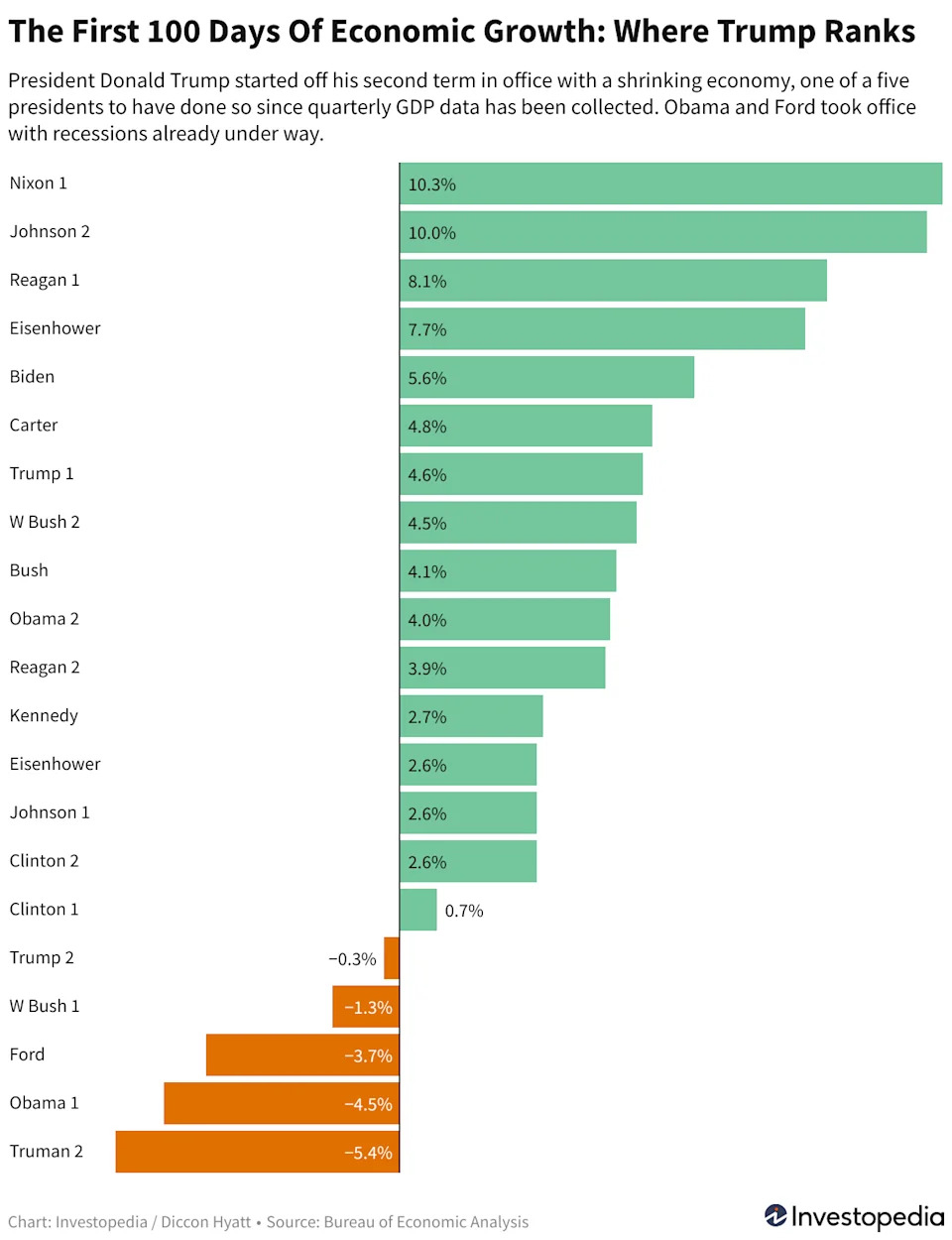

Economists said tariffs were the main reason the

nation's economic output shrank

slightly in the first quarter of 2025 after nearly three years of solid expansion. Businesses and individuals hoping to beat the tariffs bought

a record-shattering amount of imports

in March, which are subtracted from the GDP. That put Trump on a short list of postwar presidents who saw the economy shrink in their first 100 days.

One reason for the economic pullback is "

uncertainty," a word that started to appear everywhere

as Trump has repeatedly announced, repealed, and modified various import taxes. Uncertainty about future trade policy has

forced businesses to delay expansion and hiring plans

, raising risks that the U.S. economy will grind into a recession in the coming months, reports show.

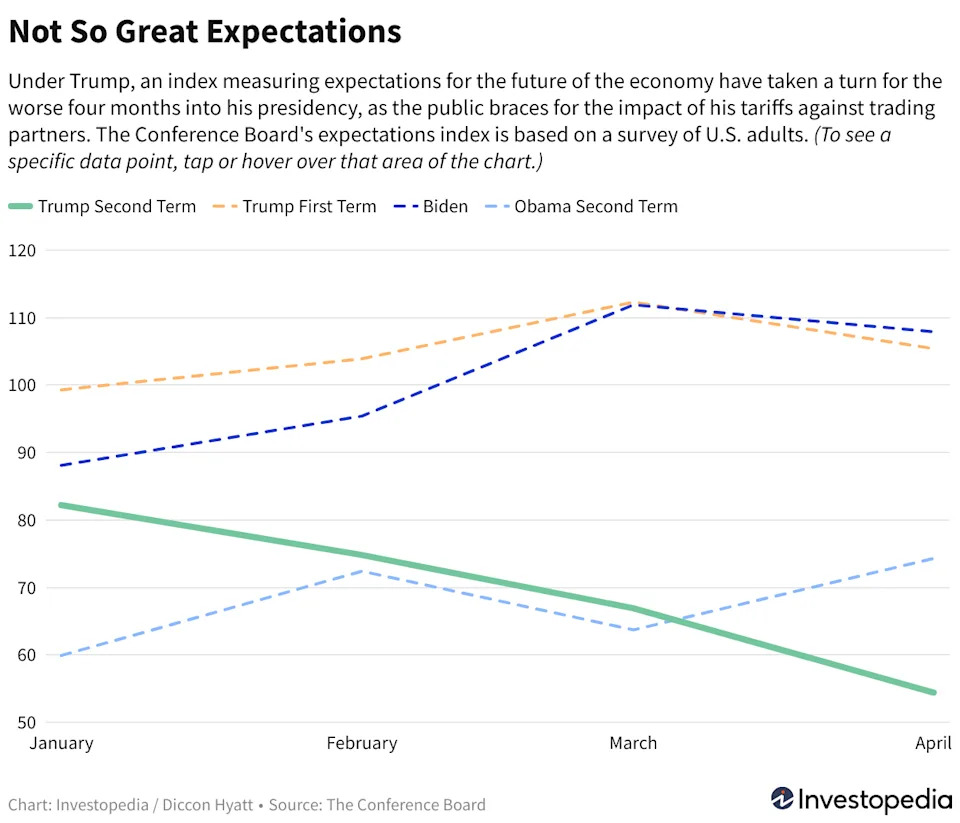

U.S. consumers, already weary of inflation, expect tariffs to push up prices even more and have grown increasingly pessimistic about the economy. The plunge in consumer confidence under Trump's second term is a stark contrast to the trend under his immediate predecessors, and himself during his first term, who all saw confidence rise.

Still, economists have noted a contrast between "soft" data such as surveys, and "hard" data that measures results.

Consumers may be fearful

about a recession,

but that hasn't stopped them from spending. Similarly, inflation measures have stayed subdued through March, and unemployment hasn't risen severely, leading some economists to predict the economy will stay resilient through the tariff turmoil.

Read the original article on Investopedia