Higher education company Laureate Education (NASDAQ:LAUR) reported revenue ahead of Wall Street’s expectations in Q1 CY2025, but sales fell by 14.2% year on year to $236.2 million. The company expects the full year’s revenue to be around $1.57 billion, close to analysts’ estimates. Its GAAP loss of $0.13 per share was 31.6% above analysts’ consensus estimates.

Is now the time to buy Laureate Education? Find out in our full research report .

Laureate Education (LAUR) Q1 CY2025 Highlights:

Eilif Serck-Hanssen, President and Chief Executive Officer, said, “We are pleased to report favorable new enrollment results during the recently completed main intake cycle in Peru and secondary intake cycle in Mexico, further reinforcing the resiliency of our business model. With increased visibility into the remainder of the year, we are tightening the range on our full-year 2025 guidance, raising the mid-point for both Revenue and Adjusted EBITDA. We remain confident in the growing demand for quality higher education in both Mexico and Peru even in a time of economic uncertainty, driven by rising participation rates and the significant wage premium earned by graduates. With our leading brands and strong digital capabilities, we are ideally positioned to capitalize on those growth opportunities. In addition, we remain committed to continuing to return excess capital to shareholders, supported by a strong balance sheet and our cash-accretive business model.”

Company Overview

Founded in 1998 by Douglas L. Becker and based in Miami, Laureate Education (NASDAQ:LAUR) is a global network of higher education institutions.

Sales Growth

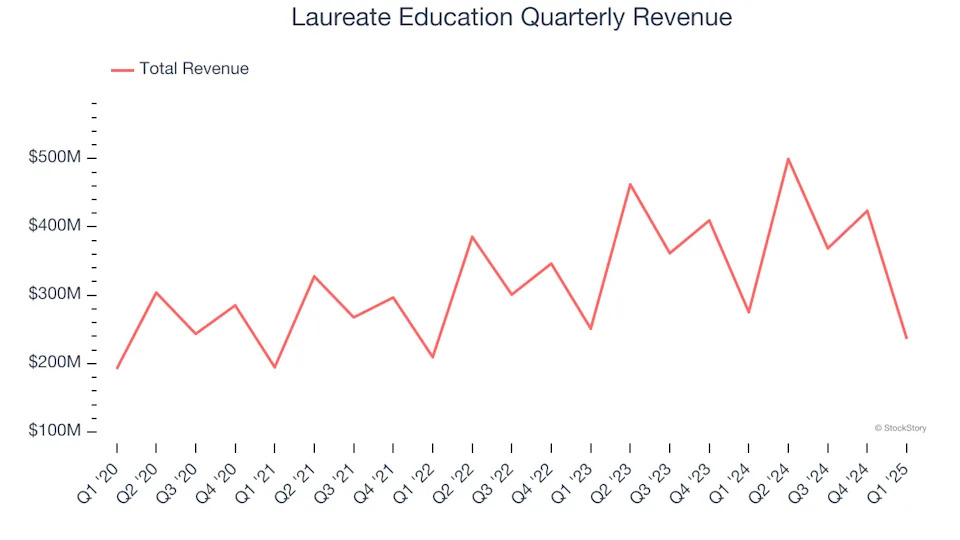

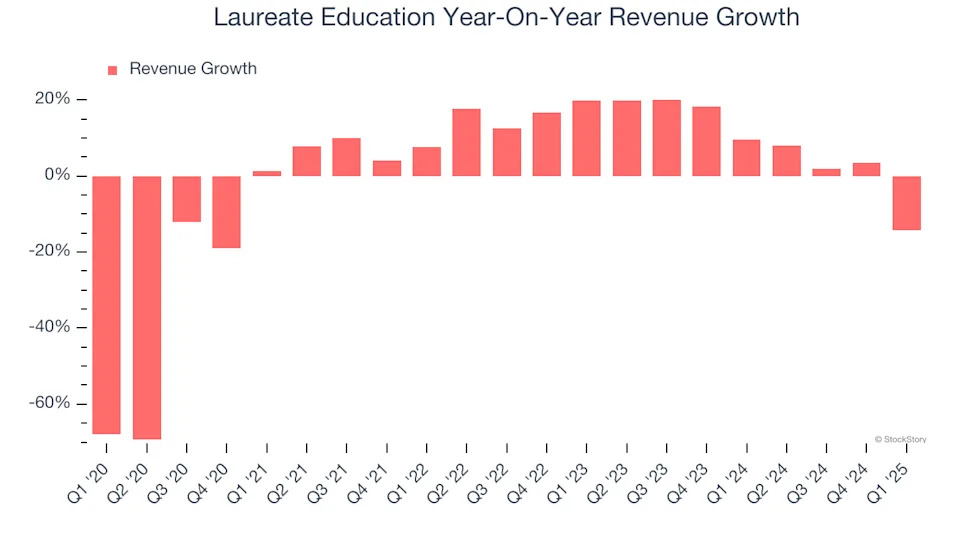

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Laureate Education’s demand was weak and its revenue declined by 3.4% per year. This was below our standards and suggests it’s a lower quality business.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Laureate Education’s annualized revenue growth of 9.1% over the last two years is above its five-year trend, but we were still disappointed by the results.

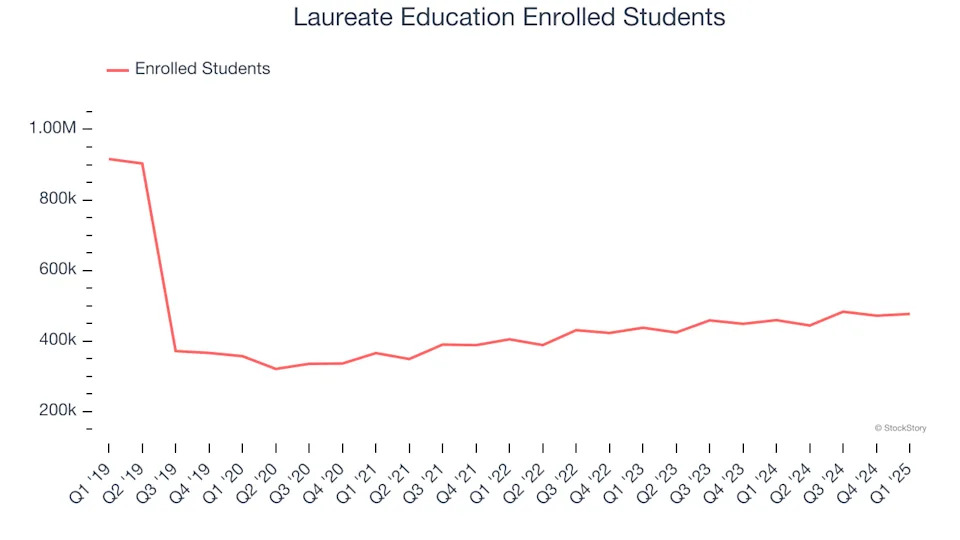

Laureate Education also discloses its number of enrolled students, which reached 477,000 in the latest quarter. Over the last two years, Laureate Education’s enrolled students averaged 5.7% year-on-year growth. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, Laureate Education’s revenue fell by 14.2% year on year to $236.2 million but beat Wall Street’s estimates by 4.9%.

Looking ahead, sell-side analysts expect revenue to grow 3.1% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

Operating Margin

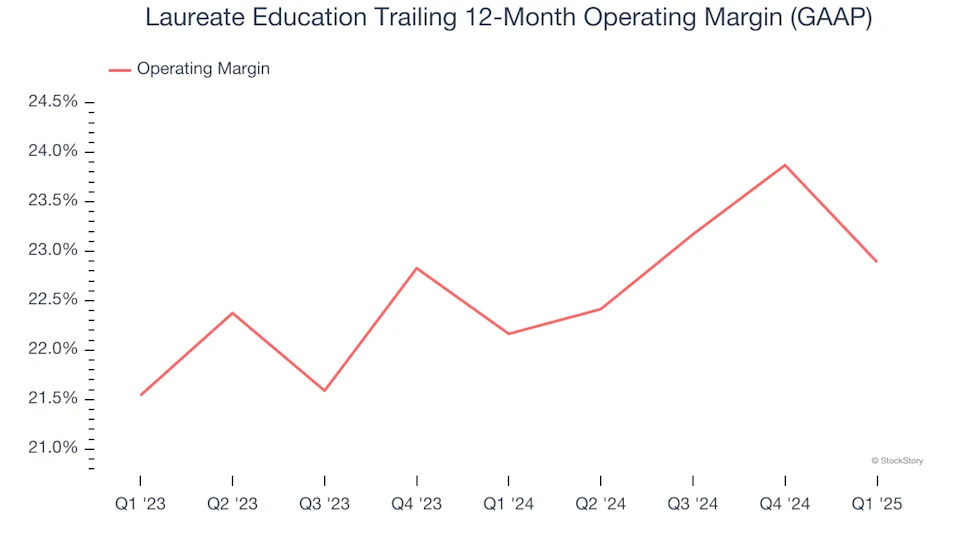

Laureate Education’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 22.5% over the last two years. This profitability was elite for a consumer discretionary business thanks to its efficient cost structure and economies of scale.

This quarter, Laureate Education generated an operating profit margin of negative 5.6%, down 9.6 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

Earnings Per Share

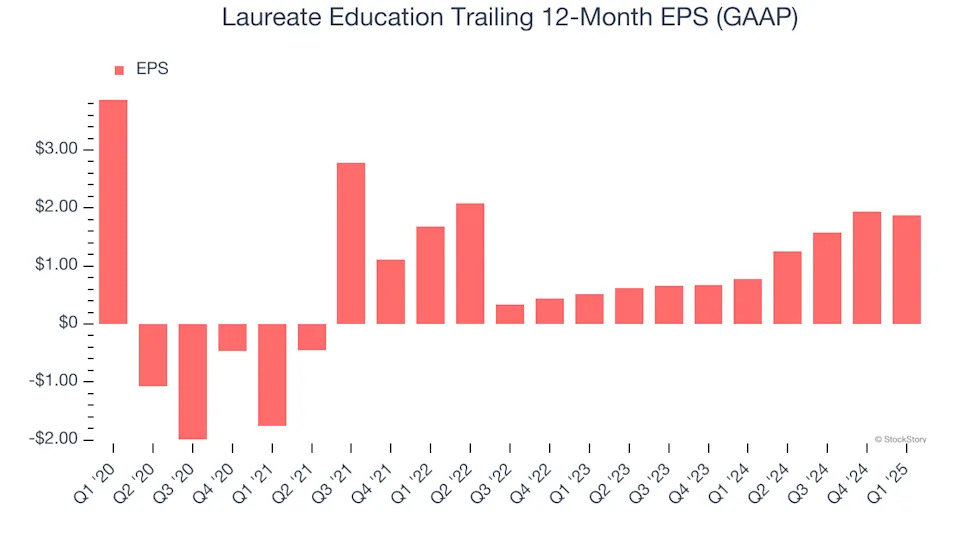

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Laureate Education, its EPS declined by 13.5% annually over the last five years, more than its revenue. We can see the difference stemmed from higher interest expenses or taxes as the company actually grew its operating margin and repurchased its shares during this time.

In Q1, Laureate Education reported EPS at negative $0.13, down from negative $0.07 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Laureate Education’s full-year EPS of $1.88 to shrink by 20.2%.

Key Takeaways from Laureate Education’s Q1 Results

We were impressed by how significantly Laureate Education blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. We were also glad it raised its full-year revenue guidance. On the other hand, its number of enrolled students missed, but we still think this was a solid quarter with some key areas of upside. The stock traded up 2.3% to $20.50 immediately after reporting.

Laureate Education may have had a good quarter, but does that mean you should invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .