(Bloomberg) -- April gave stock market investors a little bit of everything: Tears as share prices plunged when President Donald Trump started a global trade war, relief as they bounced back when he paused some of his harshest tariffs, and confusion as they rose despite increasing signs of economic turmoil.

Now that the calendar is turning to May, Wall Street simply hopes for some clarity on the Trump administration’s trade policies and Corporate America’s growth expectations. But investors probably shouldn’t hold their breath, as uncertainty appears to be the watchword at this point.

Wednesday’s trading was a prime example of that uneasiness. The S&P 500 Index plunged at the open, quickly falling as much as 2.3% after reports showed the US economy contracted in April for the first time since 2022 and that hiring slowed at US companies. But it clawed back through the day and then burst into the green about five minutes before the close to end the month on a seven-session winning streak.

“This month was like a classic V-shaped roller-coaster,” said Scott Ladner, chief investment officer at Horizon Investments LLC. “We went from very bullish on April 1 to uber-bearish on April 3, and really just one thing changed. From here on the direction of travel needs to be clear.”

Looking at the numbers, the stock market’s swing in April is pretty remarkable. After Trump’s tariff announcement on April 2, the S&P 500 plunged more 12% in four sessions. On April 9, Trump reversed himself, putting a 90-day pause on some of his most onerous levies, which sparked a 9.5% leap, the biggest one-day rally in 17 years. Since then, the market has drifted higher, with the S&P ending the month down less than 1%.

Pain Trade Positioning

But beneath the cautious rebound lurks an uneasy feeling of what’s to come.

“When you look at positioning, it is extremely clear that the ‘pain trade’ from here is still higher,” said Ladner, who describes himself as a “low-conviction bear” at the moment. Looking down the road, however, he sees several potentially bullish catalysts, such as one or multiple trade agreements, a tax cut and possibly a lower overall tariff rate after all the negotiations are done.

Ladner is selling US equities in favor of international exposure right now, but he isn’t moving to cash. And he’s not alone. Inflows into equity funds have continue to be strong, but they’re gravitating away from the US and into the rest of the world, according to data from Deutsche Bank AG on Friday. Positioning by systematic strategies is still very low, while discretionary investors have returned to almost neutral levels.

Still, overall equity positioning has risen over the last two weeks, according to Deustche Bank’s Parag Thatte, ticking higher since Trump announced the tariff pause.

High Correlations

Wall Street’s single-minded focus on trade talks has pushed the correlation between S&P 500 members to the highest level since 2020. That means the market is moving as a monolith, which leaves few places for shelter if a calamity strikes.

Rising Pessimism

Meanwhile, investors are growing increasingly pessimistic. The closely watched American Association of Individual Investors survey shows that bearish sentiment — or expectations that stock prices will fall over the next six months — is unusually high and above the historical average for the 21st time in 23 weeks.

Closing Strong

Ironically, extreme bearishness and low positioning are typically a recipe for sharp rebounds, which is what’s happening in the S&P 500. Its six-day winning streak was its longest since November, when Trump was elected, and the gain over those sessions was the biggest since March 2022.

Still, market pros urge caution. The drawdown in the S&P 500 this year is in line with declines seen in previous shallow recessions or mini-stagflation periods, HSBC strategists wrote in a note to clients on Tuesday. Some volatility traders are echoing similar concerns — don’t get too comfortable and hedge while it’s cheap.

Low-Cost Insurance

The price of one-month put contracts on the benchmark index, which are used to protect against equity declines, relative to calls — which benefit from rising stock prices — is at its lowest level since April 2.

Uncertainty Remains

The worry among strategists and investors is that the sharp reversal in stocks from the lows of earlier in the month is flying in the face of still-high levels of uncertainty. While Trump and his administration have relented on more tariffs since the initial pause — such as the reprieve for the auto industry — a resolution to the global trade war he started remains far off.

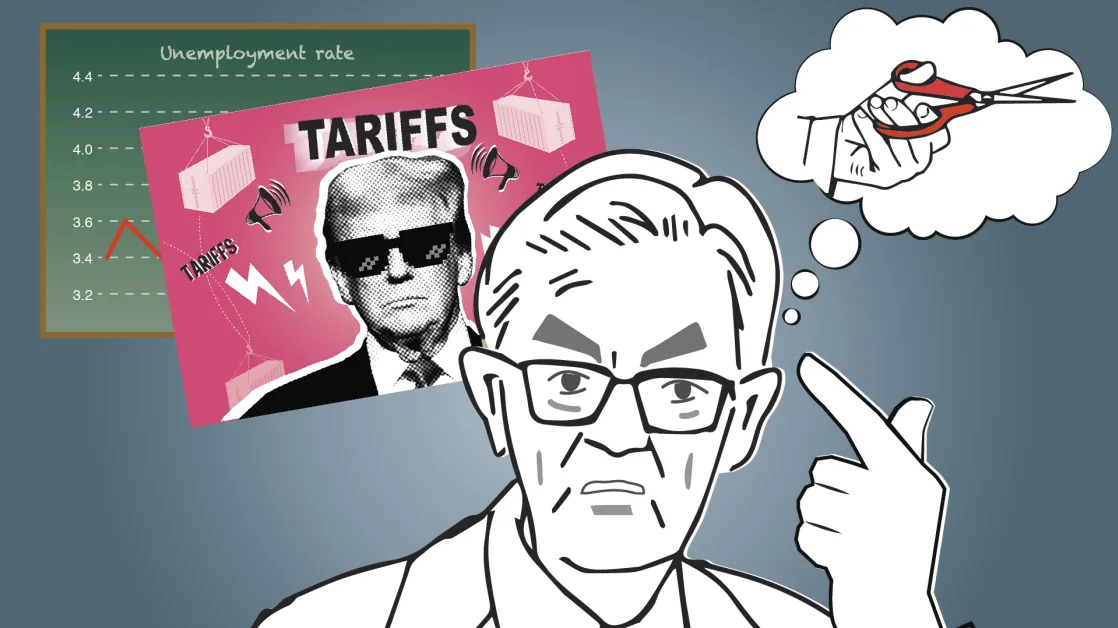

And the president continues to add risks to the mix, like his repeated attacks on Federal Reserve Chair Jerome Powell, who is a trusted figure on Wall Street. On Tuesday, Trump went after Powell again as he doubled down on his economic policies and tariff regime.

All of this creates a rebound that may be real but is unlikely to last, said Paul Christopher, head of global investment strategy at Wells Fargo Investment Institute.

“This market seems to be in the bottoming/consolidation process we tend to see after sharp declines,” Christopher said. “While we may not see a complete retest of the recent lows, we will probably revisit that area.”

--With assistance from Yiqin Shen, Bernard Goyder and Matt Turner.

(Updates trading in third paragaph and S&P 500 montly return in fifth paragraph.)