Tech giant Microsoft (NASDAQ:MSFT) announced better-than-expected revenue in Q1 CY2025, with sales up 13.3% year on year to $70.07 billion. Its GAAP profit of $3.46 per share was 7.6% above analysts’ consensus estimates.

Is now the time to buy Microsoft? Find out in our full research report .

Microsoft (MSFT) Q1 CY2025 Highlights:

Revenue Growth

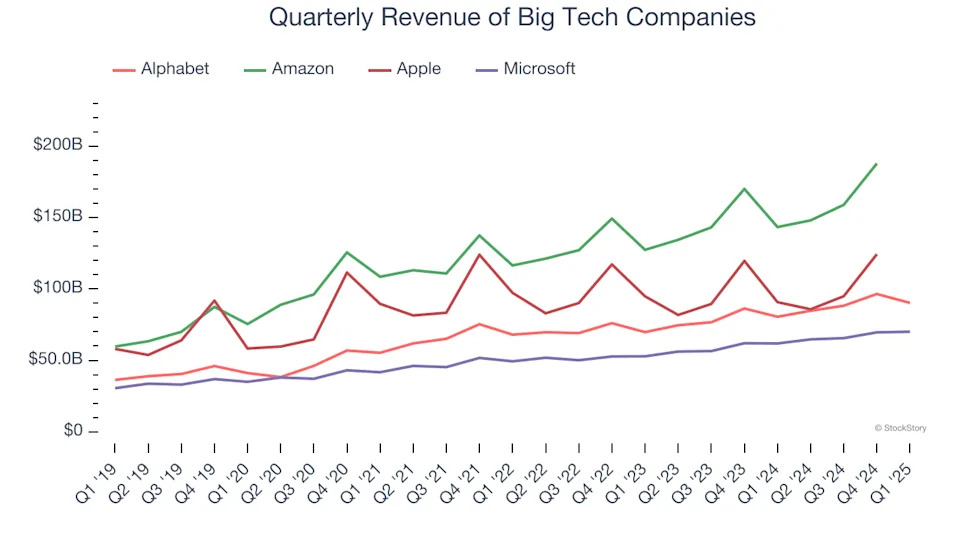

Microsoft proves that huge, scaled companies can still grow quickly. The company’s revenue base of $138.7 billion five years ago has nearly doubled to $270 billion in the last year, translating into an exceptional 14.3% annualized growth rate.

In light of its big tech peers, however, Microsoft’s growth trailed Amazon (17.9%), Alphabet (16.6%), and Apple (8.1%) over the same period. Comparing the four is relevant because investors often pit them against each other to derive their valuations. With these benchmarks in mind, we think Microsoft’s price is fair.

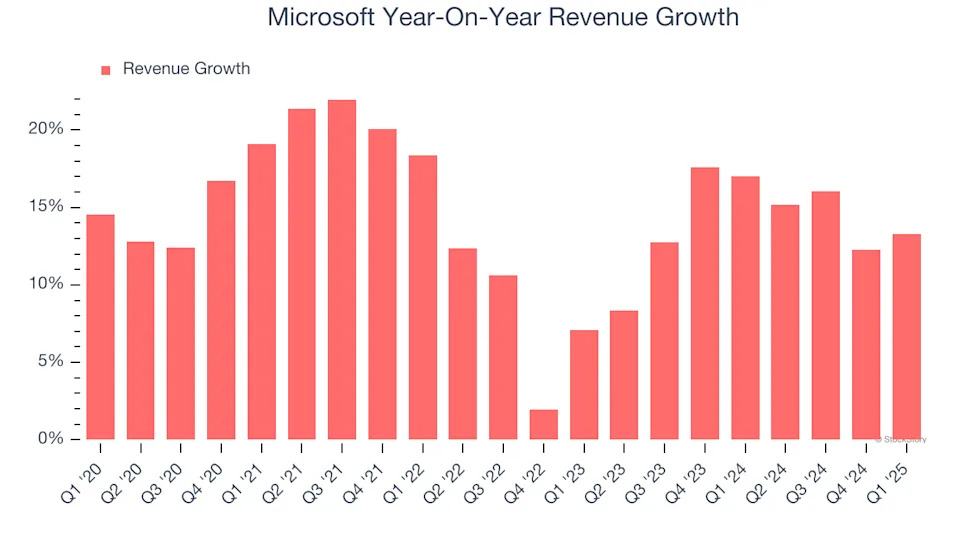

Long-term growth reigns supreme in fundamentals, but for big tech companies, a half-decade historical view may miss emerging trends in AI. Microsoft’s annualized revenue growth of 14% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

This quarter, Microsoft reported year-on-year revenue growth of 13.3%, and its $70.07 billion of revenue exceeded Wall Street’s estimates by 2.4%. Looking ahead, sell-side analysts expect revenue to grow 12% over the next 12 months, a slight deceleration versus the last two years. This projection is still healthy and illustrates the market sees some success for its newer products.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

Intelligent Cloud: Azure & Cloud Computing

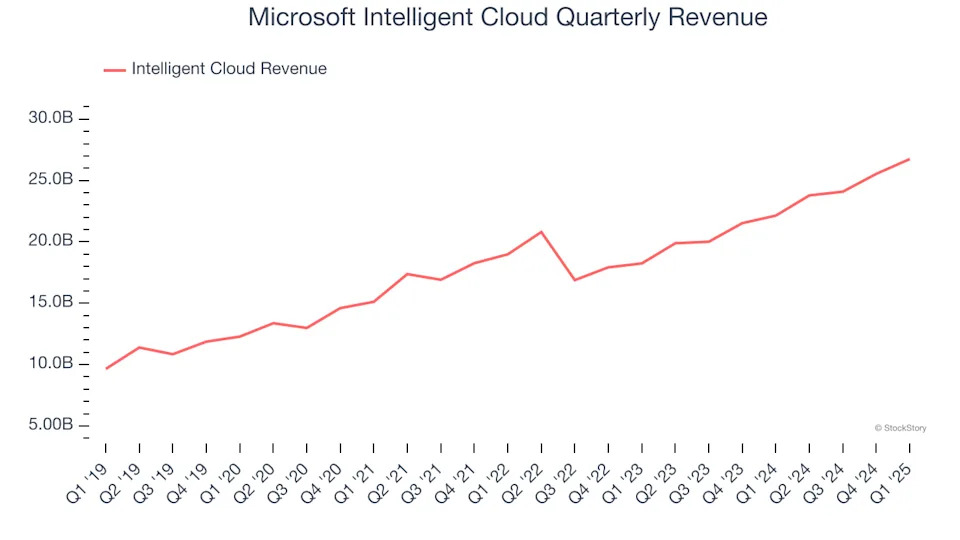

The most pressing question about Microsoft’s business is how much AI can boost its revenues. The company's cloud computing division, Intelligent Cloud, is one we watch carefully because its Azure platform and server/database offerings could be the biggest beneficiaries of the AI megatrend. The segment also boasts consistently high growth rates and shows no signs of stopping.

Intelligent Cloud is 37.1% of Microsoft’s total sales and grew at a 16.6% annualized rate over the last five years, faster than its consolidated revenues. The last two years paint a similar picture as sales grew by zero annually.

Intelligent Cloud’s 20.8% year-on-year revenue growth exceeded expectations in Q1, beating Wall Street’s estimates by 2.4%.

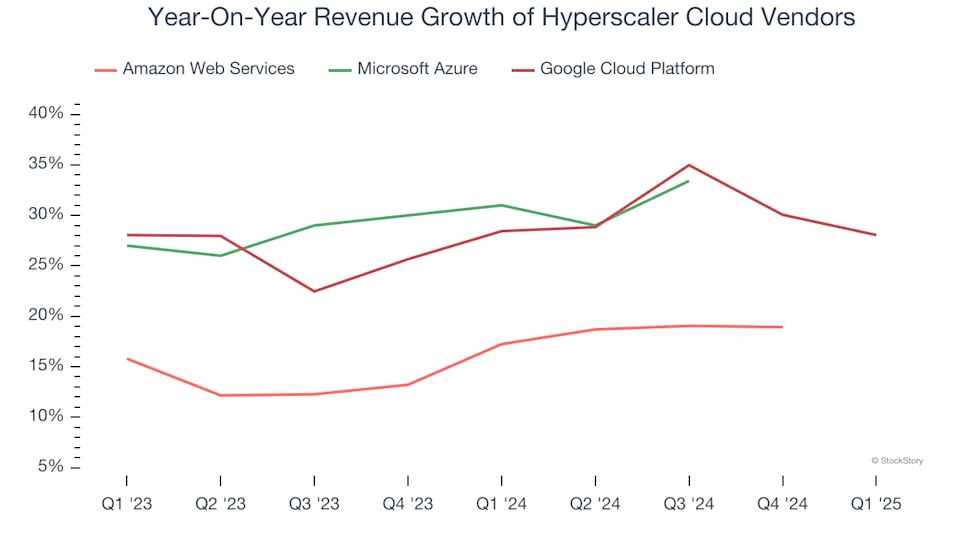

In terms of market share, Azure is a close second as its run-rate revenue (current quarter’s sales times four) is around $80 billion versus roughly $100 billion and $50 billion for AWS and Google Cloud. If Azure can continue posting high growth rates in the coming years, it certainly has a chance of catching up to AWS.

Key Takeaways from Microsoft’s Q1 Results

We enjoyed seeing Microsoft beat analysts’ revenue expectations this quarter. We were also glad its operating income outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 6% to $416.03 immediately after reporting.

Microsoft may have had a good quarter, but does that mean you should invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free .