Machine vision technology company Cognex (NASDAQ:CGNX) reported Q1 CY2025 results beating Wall Street’s revenue expectations , with sales up 2.5% year on year to $216 million. On the other hand, next quarter’s revenue guidance of $245 million was less impressive, coming in 1.7% below analysts’ estimates. Its non-GAAP profit of $0.16 per share was 20.4% above analysts’ consensus estimates.

Is now the time to buy Cognex? Find out in our full research report .

Cognex (CGNX) Q1 CY2025 Highlights:

"Reflecting on my 17-year tenure at Cognex, I am extremely proud of what we have accomplished as a team, increasing revenue fivefold to over $900 million in 2024, driven by an unwavering dedication to innovation and excellence," Mr. Willett commented.

Company Overview

Founded in 1981 when computer vision was in its infancy, Cognex (NASDAQ:CGNX) develops machine vision systems and software that help manufacturers and logistics companies automate quality inspection and tracking of products.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $919.8 million in revenue over the past 12 months, Cognex is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

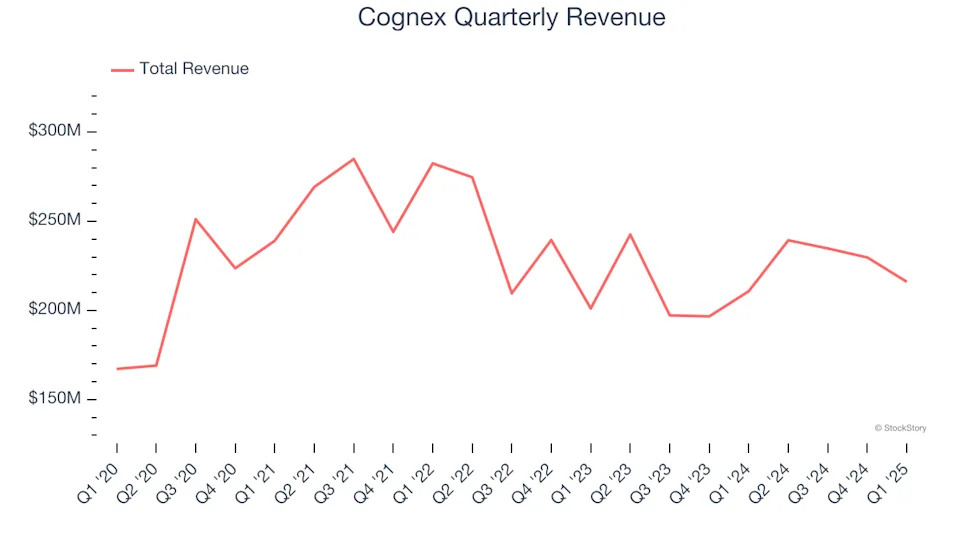

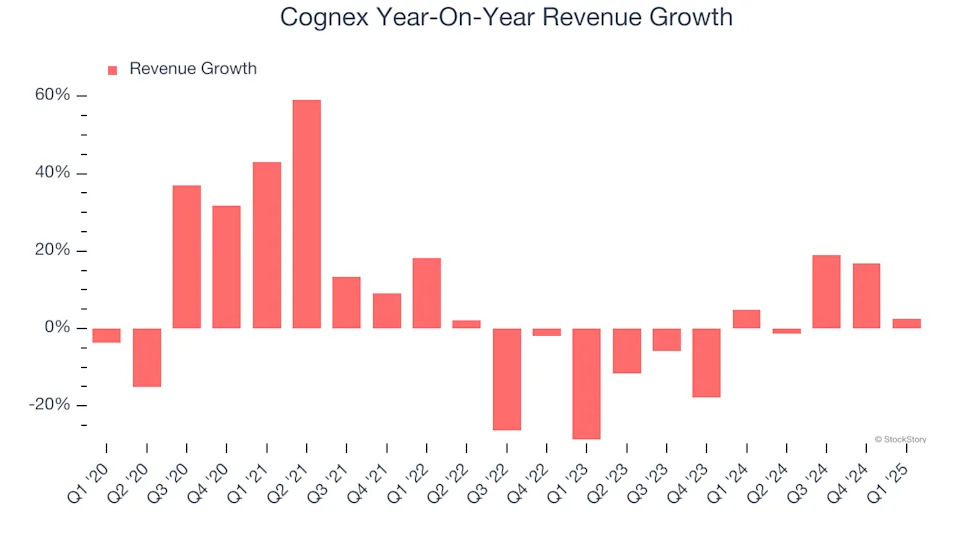

As you can see below, Cognex grew its sales at a decent 5% compounded annual growth rate over the last five years. This shows its offerings generated slightly more demand than the average business services company, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Cognex’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

This quarter, Cognex reported modest year-on-year revenue growth of 2.5% but beat Wall Street’s estimates by 1.9%. Company management is currently guiding for a 2.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.5% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and implies its newer products and services will catalyze better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

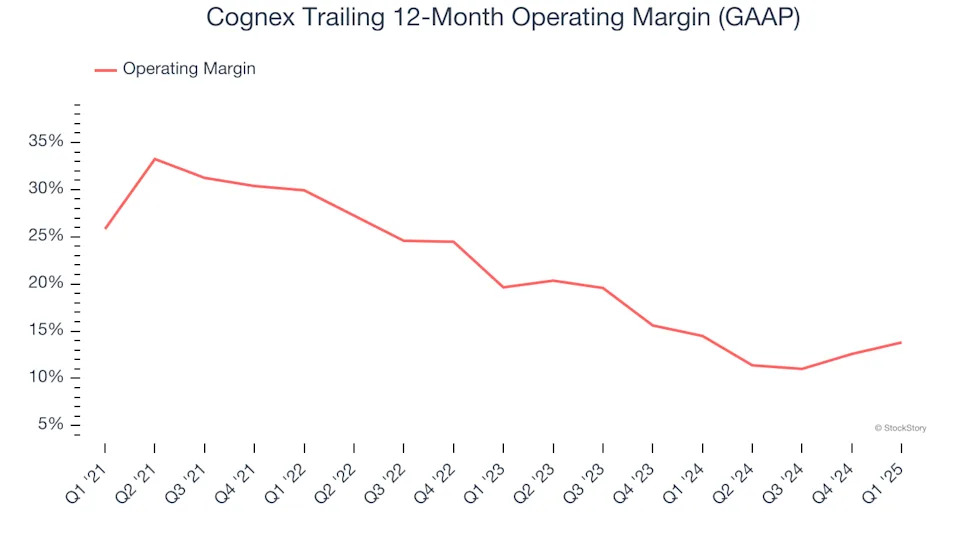

Cognex has been a well-oiled machine over the last five years. It demonstrated elite profitability for a business services business, boasting an average operating margin of 21.1%.

Looking at the trend in its profitability, Cognex’s operating margin decreased by 12 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Cognex generated an operating profit margin of 12.1%, up 5.3 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

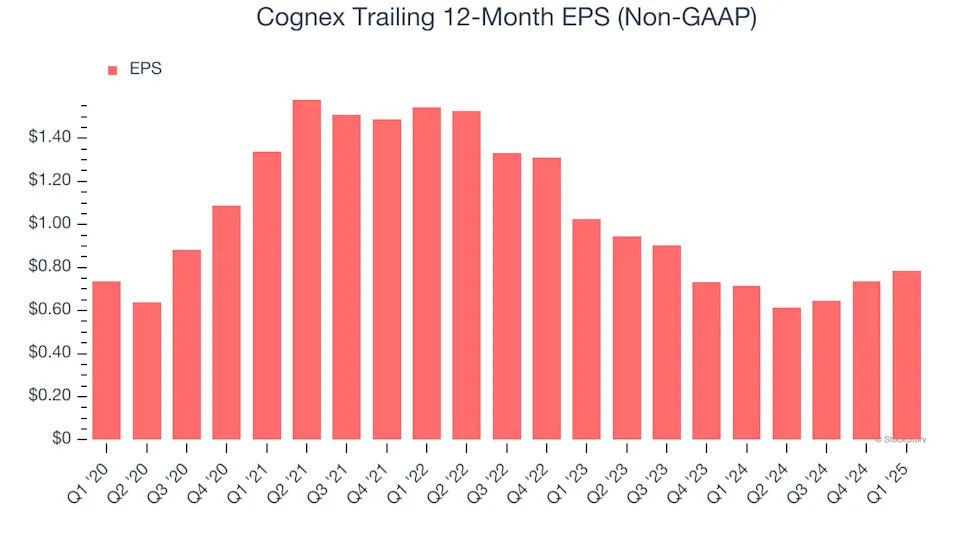

Cognex’s EPS grew at a weak 1.3% compounded annual growth rate over the last five years, lower than its 5% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

Diving into the nuances of Cognex’s earnings can give us a better understanding of its performance. As we mentioned earlier, Cognex’s operating margin improved this quarter but declined by 12 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, Cognex reported EPS at $0.16, up from $0.11 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Cognex’s full-year EPS of $0.78 to grow 15.7%.

Key Takeaways from Cognex’s Q1 Results

We were impressed by how significantly Cognex beat analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed. Overall, this quarter had some key positives. The areas below expectations seem to be driving the move, and shares traded down 1.7% to $26.80 immediately after reporting.

Should you buy the stock or not? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free .