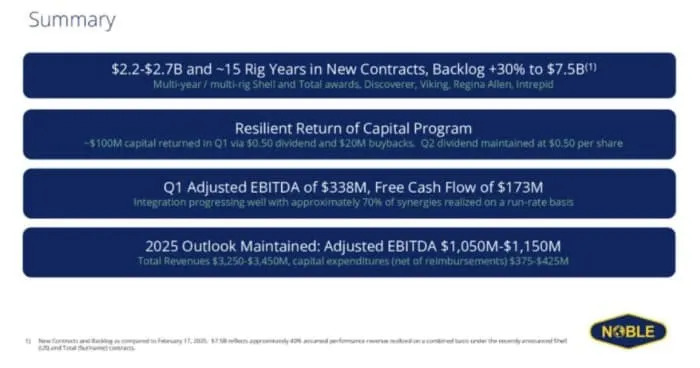

Noble Corp, (NYSE:NE) turned in a pretty solid report for Q-1 this week, and gave a forecast that caused the stock to rally sharply, up 12%, on the news. Over the course of the day, where oil prices had dropped to around $60, it managed to hold onto a good chunk of that gain. Key among the salient points of the release was the announcement of a $2.0-$2.5 bn addition to the company's backlog in the quarter, bringing the total to $7.5 bn on the upside. Anytime you can announce a 30% increase in future contracted revenues, you're doing something right and will attract investors’ attention. Even when you miss slightly on EPS guidance for the quarter, $0.26 vs expectations of $0.35.

Equally important for investors was the confidence the company expressed about an observed backlog "inflection" in the market, and a strong pipeline of new contracting opportunities. It is important for investors that key players, like Noble, express optimism about the health of the deepwater market, and given the reaction today, they have nicely ticked that box. The stock prices of offshore drillers, such as OSD, have been crushed over the last six months as white space in drilling schedules and a lack of backlog additions have caused doubts about an eventual recovery in the OSD sector. Noble’s Q-1 report put a lot of those fears to rest.

A transformative contract in the Gulf of America with Shell

The announcement of the Shell GOA contract for two 7-G rigs, with a 4-year timeline and over $1.2 bn in guaranteed revenue, was what the market had been waiting to see. That works out to $ 465,000 per day, which, for a contract of that length, sets the bar for top-tier assets. These

It brings a couple of things to mind. The first being that Shell has a significant amount of GOA work planned over the specified time period. The second is that they are willing to commit big bucks to have these rigs available at today's rates. Meaning that if they did a shorter deal, the day rate might be higher, costing them more in the long run. This is the type of contract NE has alluded to as being on the horizon in past quarters. One that provides long-term revenues at competitive day rates, supporting margins and cash flow for operations and investor returns.

NE is incurring some upgrade capital expenditures for these rigs, including hookload to 2.8 mm lbs, a controlled pressure mud line, which precludes the need for managed pressure drilling (MPD) equipment, heave-compensated cranes, and a few other items. They figure $60-70 mm per rig. In a 4-year deal with performance incentives, that's no big deal.

Again related to the Shell contract, we haven't seen in a while. A long while. Performance bonuses to the day rate of 20% will apply if certain incentives were met. They weren't specific but it's very likely these are related to beating the AFE technical limit curve, and doing so with no recordable safety incidents. Time and safety are always integral to Shell contracts.

If that wasn't enough Total, (NYSE: TTE) picked up two rigs-1 7-G drillship and a 6-G Semi, for their work offshore Suriname. The contracts span 16 wells per rig or approximately 1,060 days each and are expected to commence between Q4 2026 and Q1 2027. Total revenue is $753 million, with an additional $297 million in upside potential from performance bonuses. Across both rigs were also four one-well options that could extend the life of the contract.

There were other positive commercial items cited in the call, but these are the ones that drove the stock price higher

Q-1, financials and guidance

Drilling revenue for the first quarter totaled $832 million, adjusted EBITDA was $338 million, and adjusted EBITDA margin was 39%. Q1 cash flow from operations was $271 million, net capital expenditures were $98 million, and free cash flow was $173 million.

Total backlog as of April 28th stands at $7.5 billion, up approximately 30% versus the prior quarter.

Noble paid $80 million in dividends and repurchased $20 million of shares during Q1. Yesterday, our Board declared another $0.50 per share dividend for the second quarter of 2025. It is worth noting that the dividend component of this well-funded shareholder return program is yielding nearly 10% at current share prices. Solidly covered dividends with a yield this high are rare indeed.

Full year guidance ranges, including total revenue between $3.25 billion to $3.45 billion, adjusted EBITDA between $1.05 billion to $1.15 billion, and capital expenditures, which excludes customer reimbursements of between $375 billion and $425 billion.

Company filings

Risks

Further-short term I would think, share price deterioration if WTI and Brent break down completely. An eventuality that’s not off the table at this point. How low could it go? That is the eternal question. Zero is the answer, but with the improving market and solid balance sheet, we don’t view it as a significant risk.

There is also some white space on their calendar in the near term to medium term, as noted below. The company mentioned discussions that could color in this space.

“We still expect this contracted rig count to sag a bit lower through the rest of this year, with an anticipated inflection sometime in 2026. Although, admittedly, forecasting precision is definitely hampered at the moment. But again, we do have decent visibility for some additional work for our fleet, which would support a materially improved contracted position by next year.”

Company filings

Your takeaway

If you have any faith in the deep-water market rebounding, buying NE at current prices is a solid choice for capital allocation. I have previously branded them as best in class, and stand by that comment. Robert Eifler, CEO, commented on the market outlook-

“We still see a choppy spot market for deepwater and jackups throughout 2025 and into 2026. However, we also believe that the medium- to long-term fundamentals are actually enhanced by every month of curtailed investment and spare capacity being unwound. Contracted UDW utilization has been flat with total rig count having dipped only slightly from 100 rigs to 99 rigs since the time of our last earnings call, offset by a two-rig reduction in marketed supply, leaving marketed utilization essentially unchanged at 90%.”

That sounds bullish to me for investors with a little patience. With their ability to land a huge contract like Shell, NE has demonstrated a market preference for their assets. That rings true from my experience in the field. I was always glad to hit a Noble rig. Noble was and is a class act and rates a Strong Buy at current levels, based on EV/EBITDA-4.3X, solid financials, shareholder returns and a long pipeline of high margin cash flow.

By David Messler for Oilprice.com

Read this article on OilPrice.com